Unveiling the Power of Tax Assessor Maps: A Comprehensive Guide

Related Articles: Unveiling the Power of Tax Assessor Maps: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Unveiling the Power of Tax Assessor Maps: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unveiling the Power of Tax Assessor Maps: A Comprehensive Guide

Tax assessor maps, often referred to as property maps, are indispensable tools in the realm of property assessment and taxation. These detailed visual representations provide a comprehensive overview of a jurisdiction’s real estate landscape, encompassing crucial information about individual properties and their surrounding environment. This article delves into the intricacies of tax assessor maps, exploring their significance, components, benefits, and applications.

Understanding the Essence of Tax Assessor Maps

Tax assessor maps serve as the foundation for a fair and accurate property tax system. They are meticulously compiled and maintained by local government agencies, often the assessor’s office, to ensure equitable taxation based on property values. These maps offer a visual blueprint of a region, meticulously documenting property boundaries, dimensions, features, and even historical data.

Key Components of a Tax Assessor Map

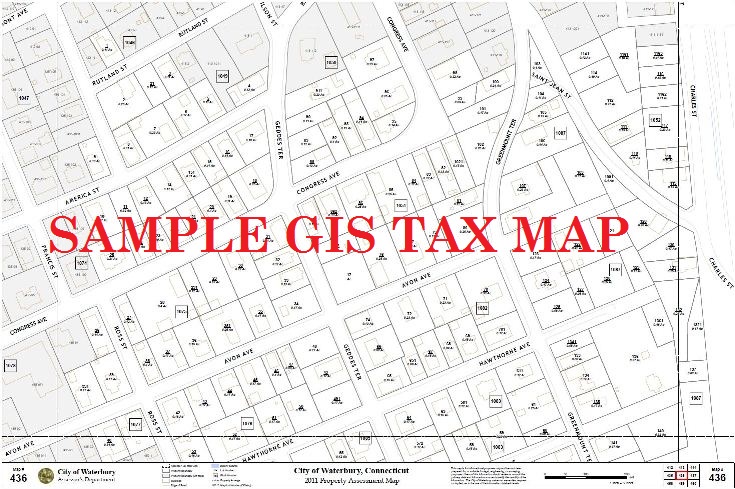

Tax assessor maps are not merely simple sketches; they are intricate documents brimming with information. Here are the key elements that typically comprise a tax assessor map:

- Property Boundaries: Clearly defined lines representing the legal limits of each property, ensuring accurate measurement and identification.

- Parcel Numbers: Unique identifiers assigned to each property, facilitating easy referencing and retrieval of information.

- Property Features: Detailed depictions of buildings, structures, improvements, and other relevant features on each property.

- Land Use: Indication of the designated purpose of each property, such as residential, commercial, industrial, or agricultural.

- Zoning Information: Depiction of zoning regulations applicable to each property, guiding development and land use decisions.

- Utilities: Mapping of essential utilities like water, sewer, electricity, and gas lines, providing valuable infrastructure insights.

- Topographical Features: Representation of natural features like rivers, lakes, hills, and valleys, offering a comprehensive understanding of the terrain.

- Historical Data: Inclusion of historical records such as previous ownership, property transactions, and changes in land use over time.

The Significance and Benefits of Tax Assessor Maps

Tax assessor maps play a pivotal role in various aspects of property management and development, offering numerous benefits:

- Accurate Property Valuation: Tax assessor maps provide the foundation for accurate property valuations, ensuring fair and equitable property tax assessments.

- Transparent Taxation: The detailed information on these maps fosters transparency in the tax assessment process, allowing property owners to understand the rationale behind their tax bills.

- Effective Land Management: These maps facilitate efficient land management by providing a clear overview of property boundaries, zoning regulations, and infrastructure, aiding in development planning and regulatory compliance.

- Property Transactions: Real estate professionals, investors, and potential buyers rely heavily on tax assessor maps to gain insights into property details, boundaries, and surrounding features, facilitating informed decisions during property transactions.

- Disaster Response and Planning: During emergencies or natural disasters, tax assessor maps provide valuable information for emergency responders, aiding in evacuation planning, damage assessment, and resource allocation.

- Infrastructure Development: These maps guide infrastructure development projects by providing insights into property boundaries, utility locations, and surrounding environment, ensuring efficient and effective infrastructure planning.

- Environmental Planning: Tax assessor maps contribute to sustainable development by providing data on land use, natural features, and infrastructure, enabling informed environmental planning and conservation efforts.

- Historical Research: The historical data incorporated into tax assessor maps offers valuable insights into land ownership, property use, and development patterns over time, contributing to historical research and understanding the evolution of a region.

Accessing Tax Assessor Maps

Tax assessor maps are typically accessible through various channels:

- Local Assessor’s Office: Most jurisdictions maintain their tax assessor maps online or offer access through their offices, allowing individuals to view and download them.

- Public Records Websites: Many online platforms provide access to public records, including tax assessor maps, offering a convenient way to retrieve information.

- Real Estate Websites: Several real estate websites incorporate tax assessor maps into their property listings, allowing users to visualize property boundaries and features.

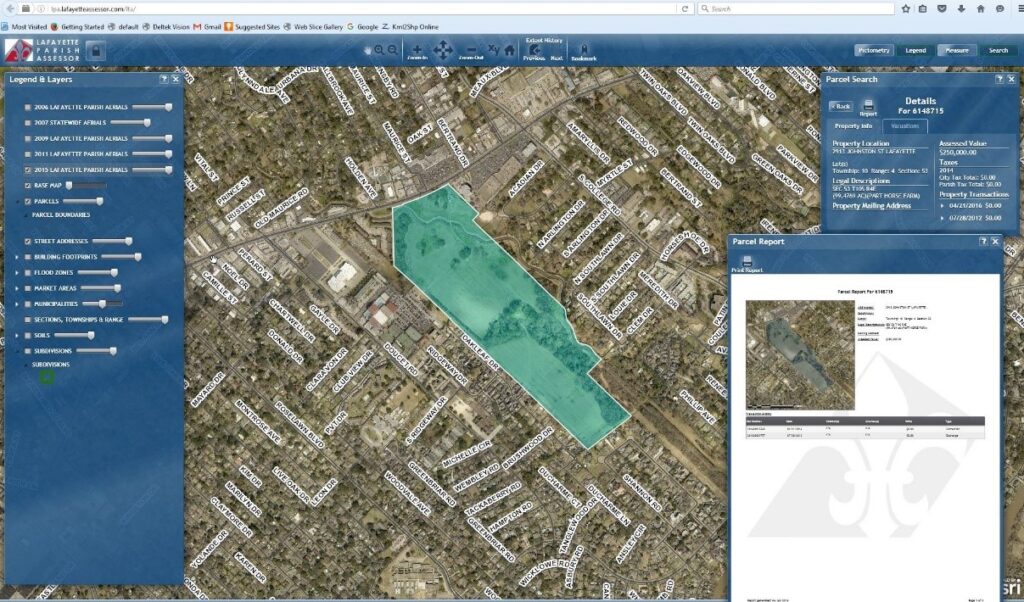

- GIS (Geographic Information System) Platforms: Advanced GIS platforms offer interactive maps with layers of data, including tax assessor maps, enabling comprehensive analysis and visualization.

Frequently Asked Questions (FAQs) About Tax Assessor Maps

1. How can I access tax assessor maps for my area?

You can typically access tax assessor maps through the website of your local assessor’s office, public records websites, real estate websites, or GIS platforms.

2. What information is included on a tax assessor map?

Tax assessor maps typically include property boundaries, parcel numbers, property features, land use, zoning information, utilities, topographical features, and historical data.

3. How often are tax assessor maps updated?

The frequency of updates varies depending on the jurisdiction, but most assessor’s offices update their maps annually or more frequently to reflect changes in property ownership, development, and infrastructure.

4. Can I use a tax assessor map to determine property values?

While tax assessor maps provide information about property features and boundaries, they do not directly indicate property values. Property values are determined through a separate assessment process.

5. Are tax assessor maps publicly available?

Yes, tax assessor maps are generally considered public records and are accessible to the public, subject to any applicable privacy regulations.

6. How are tax assessor maps used for property tax assessments?

Tax assessor maps provide the framework for property tax assessments by defining property boundaries, identifying features, and providing data for valuation calculations.

7. Can I use a tax assessor map to identify potential development opportunities?

Yes, tax assessor maps can be used to identify potential development opportunities by providing insights into property boundaries, zoning regulations, and surrounding infrastructure.

8. Are tax assessor maps accurate and reliable?

Tax assessor maps are generally considered accurate and reliable, as they are meticulously compiled and maintained by government agencies. However, it’s always advisable to verify information with the assessor’s office or other reliable sources.

Tips for Utilizing Tax Assessor Maps

- Understand the scale and units of measurement used on the map.

- Pay attention to the legend and symbols to interpret the information correctly.

- Use the map in conjunction with other relevant data sources, such as property records and zoning regulations.

- Consult with a qualified professional for assistance in interpreting and applying the information on the map.

- Keep abreast of updates and changes to the maps as they are revised regularly.

Conclusion

Tax assessor maps are essential tools for understanding and managing property within a jurisdiction. Their detailed information provides a comprehensive overview of property boundaries, features, and surrounding environment, facilitating accurate property valuations, transparent taxation, and effective land management. By leveraging the insights provided by these maps, individuals, businesses, and government agencies can make informed decisions regarding property transactions, development projects, and land use planning, contributing to a more equitable and sustainable future.

Closure

Thus, we hope this article has provided valuable insights into Unveiling the Power of Tax Assessor Maps: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!