Unveiling the Landscape: A Comprehensive Guide to the Florence County Tax Map

Related Articles: Unveiling the Landscape: A Comprehensive Guide to the Florence County Tax Map

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unveiling the Landscape: A Comprehensive Guide to the Florence County Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unveiling the Landscape: A Comprehensive Guide to the Florence County Tax Map

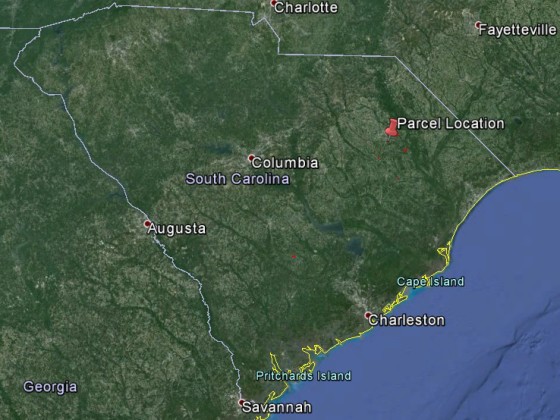

The Florence County Tax Map, a meticulously crafted document, serves as a cornerstone for understanding the county’s diverse landscape and its intricate property ownership structure. This map, a vital tool for both residents and professionals, provides a detailed visual representation of land parcels, their boundaries, and associated tax information. Its significance transcends mere property identification, offering a comprehensive view of the county’s development, economic activity, and even its environmental characteristics.

Delving into the Details:

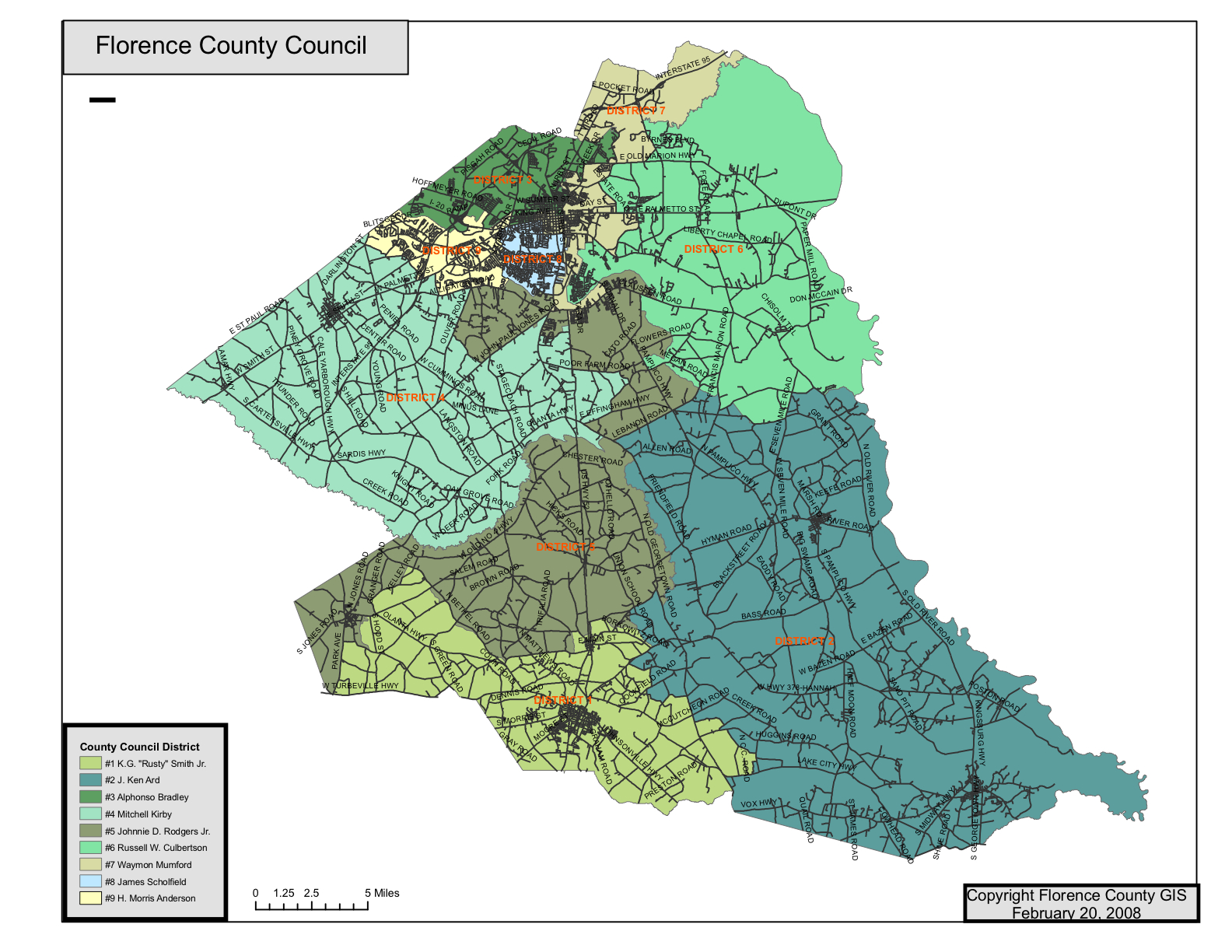

The Florence County Tax Map is not simply a static image; it is a dynamic database, constantly evolving to reflect changes in property ownership, land use, and tax assessments. Its core components include:

- Parcel Identification: Each parcel of land within Florence County is assigned a unique identifier, often referred to as a "parcel number" or "tax map number." This number serves as a primary key for accessing detailed information associated with the property.

- Boundaries: The map meticulously outlines the boundaries of each parcel, using precise coordinates and survey data. This ensures accurate representation of property lines and prevents potential disputes.

- Ownership Information: The map clearly indicates the current owner of each parcel, including their name and address. This information is crucial for communication, property transactions, and tax collection.

- Property Characteristics: The map may include additional details about each property, such as its acreage, zoning classification, and the presence of structures. This information provides valuable insights into the property’s potential use and its impact on the surrounding environment.

- Tax Assessment: Each parcel is assigned a tax assessment value, which forms the basis for calculating property taxes. This assessment is determined by factors such as the property’s market value, its location, and its potential for generating income.

Beyond the Surface: Applications and Benefits

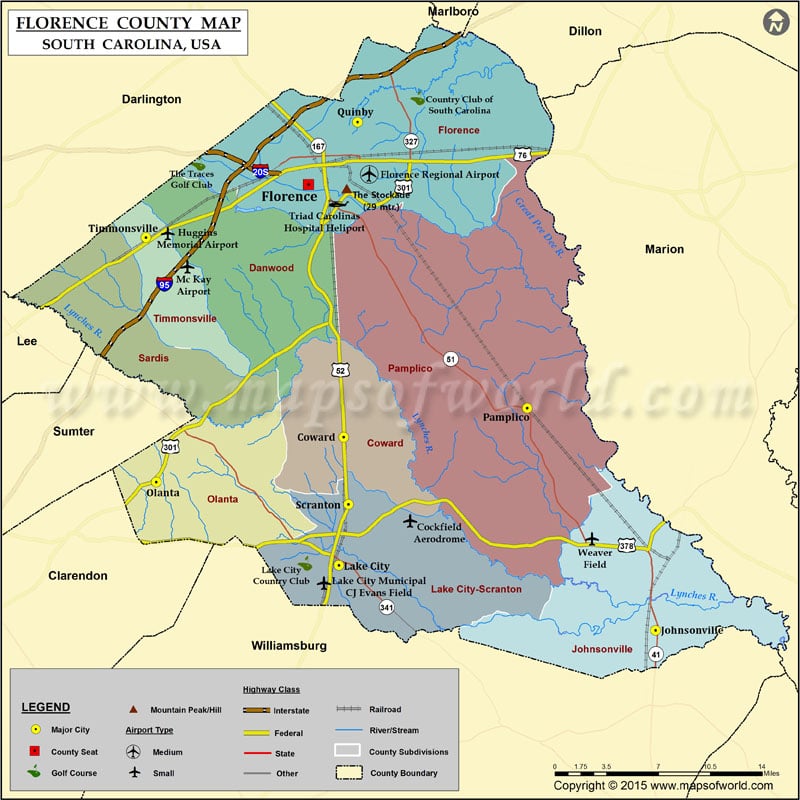

The Florence County Tax Map is a versatile tool with numerous applications, serving the needs of a diverse range of stakeholders:

- Property Owners: The map allows property owners to easily identify their land, understand its boundaries, and access crucial information about their tax obligations. It also facilitates property transactions by providing a clear picture of the property’s characteristics and its legal status.

- Real Estate Professionals: Real estate agents, appraisers, and developers rely on the tax map to conduct property research, assess market value, and identify potential development opportunities. The map’s detailed information assists in property marketing and valuation, ensuring informed decision-making.

- Government Agencies: County officials, planning departments, and tax assessors utilize the map for various purposes, including property tax administration, land use planning, and environmental management. The map provides a comprehensive overview of the county’s land use patterns, facilitating informed policy decisions.

- Businesses: Businesses seeking new locations, expanding operations, or investing in infrastructure rely on the tax map to understand the availability of suitable land, assess property values, and identify potential environmental constraints.

- Community Members: The map empowers residents to understand their neighborhood, identify potential development projects, and engage in local planning initiatives. Its accessibility fosters transparency and citizen participation in community development.

Navigating the Map: Access and Resources

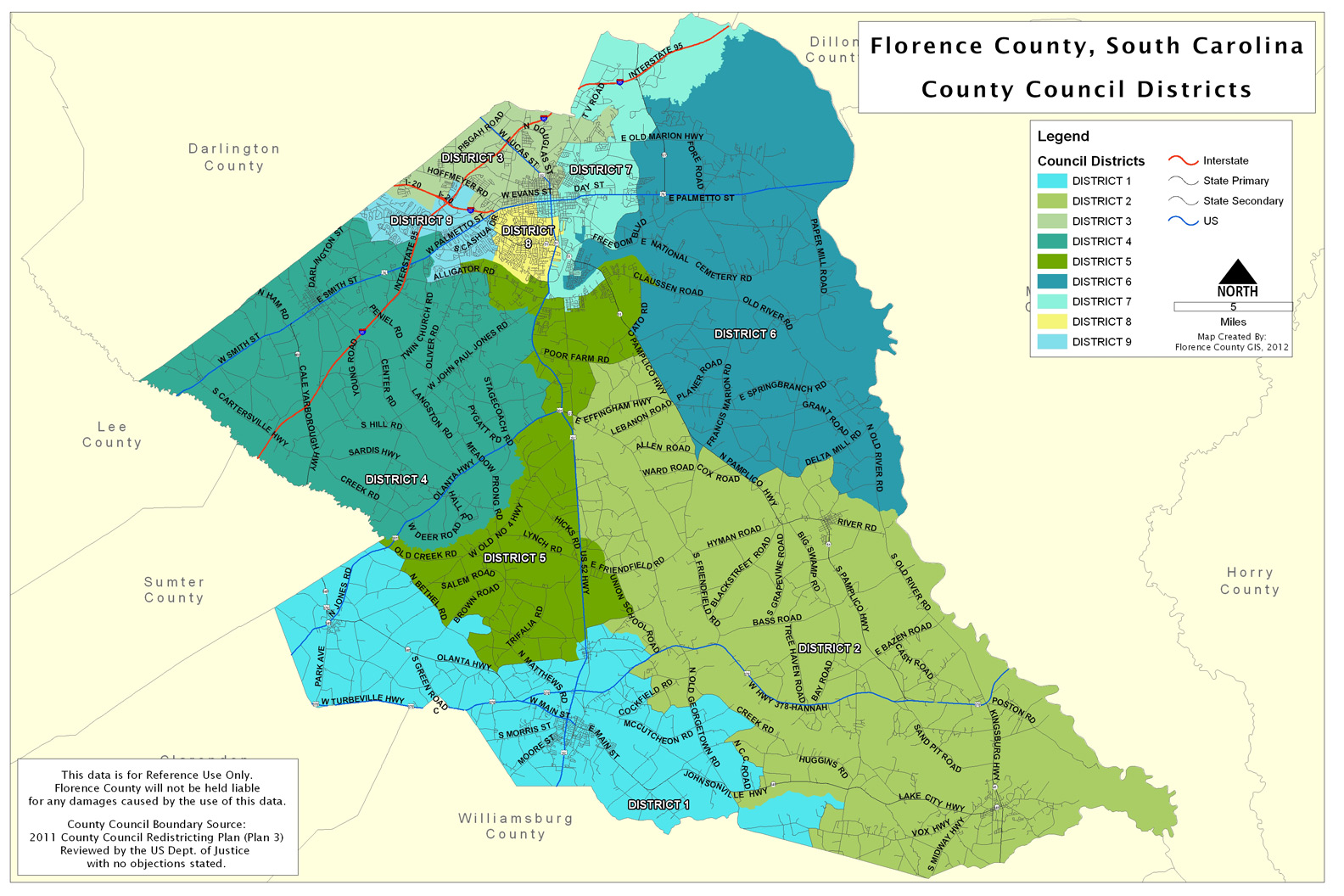

The Florence County Tax Map is typically accessible through various means, including:

- Online Platforms: Many counties offer online access to their tax maps through dedicated websites or GIS platforms. These platforms allow users to search for specific parcels, view map layers, and download data.

- County Offices: The Florence County Assessor’s Office or the County GIS Department may provide access to physical copies of the tax map or offer assistance in interpreting the map’s information.

- Private Vendors: Several companies specialize in providing property data and maps, including tax maps. These vendors may offer enhanced features such as interactive maps, aerial imagery, and property value analysis.

Frequently Asked Questions (FAQs):

Q: How can I find my property on the Florence County Tax Map?

A: You can typically find your property by searching for its address or parcel number on the county’s online tax map platform. If you are unsure of your parcel number, you can contact the Florence County Assessor’s Office for assistance.

Q: What information is included on the Florence County Tax Map?

A: The map provides detailed information about each parcel, including its boundaries, ownership details, property characteristics, and tax assessment value. Specific information may vary depending on the county’s data collection practices.

Q: Can I access the Florence County Tax Map for free?

A: Many counties offer free online access to their tax maps. However, some counties may charge a fee for accessing specific data or for downloading map files.

Q: How often is the Florence County Tax Map updated?

A: The frequency of updates depends on the county’s policies and the volume of property transactions. Generally, tax maps are updated periodically to reflect changes in ownership, land use, and tax assessments.

Q: Can I use the Florence County Tax Map for legal purposes?

A: While the tax map provides valuable information, it should not be used as a substitute for official legal documents such as deeds or survey plats. For legal purposes, it is essential to consult with a qualified professional.

Tips for Using the Florence County Tax Map Effectively:

- Start with a clear purpose: Define your objective before using the tax map, whether it’s researching a specific property, understanding property values, or identifying potential development opportunities.

- Utilize available resources: Explore the county’s online platforms, contact the Assessor’s Office, or consult with real estate professionals to maximize your use of the map.

- Understand map layers: Familiarize yourself with the different layers available on the tax map, such as zoning, land use, and property characteristics.

- Verify information: Always cross-reference information obtained from the tax map with official records or consult with experts for accurate and reliable data.

- Stay informed about updates: Regularly check for updates to the tax map to ensure you are using the most current information.

Conclusion:

The Florence County Tax Map is a powerful tool that unlocks a wealth of information about the county’s landscape, property ownership, and development patterns. By providing a detailed visual representation of land parcels, their boundaries, and associated tax information, the map empowers individuals, businesses, and government agencies to make informed decisions, navigate property transactions, and contribute to the county’s sustainable development. Its accessibility, versatility, and constant evolution ensure that the Florence County Tax Map remains a vital resource for understanding and shaping the county’s future.

Closure

Thus, we hope this article has provided valuable insights into Unveiling the Landscape: A Comprehensive Guide to the Florence County Tax Map. We appreciate your attention to our article. See you in our next article!