Navigating the Landscape: Understanding the USDA Loan Program in California

Related Articles: Navigating the Landscape: Understanding the USDA Loan Program in California

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Landscape: Understanding the USDA Loan Program in California. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape: Understanding the USDA Loan Program in California

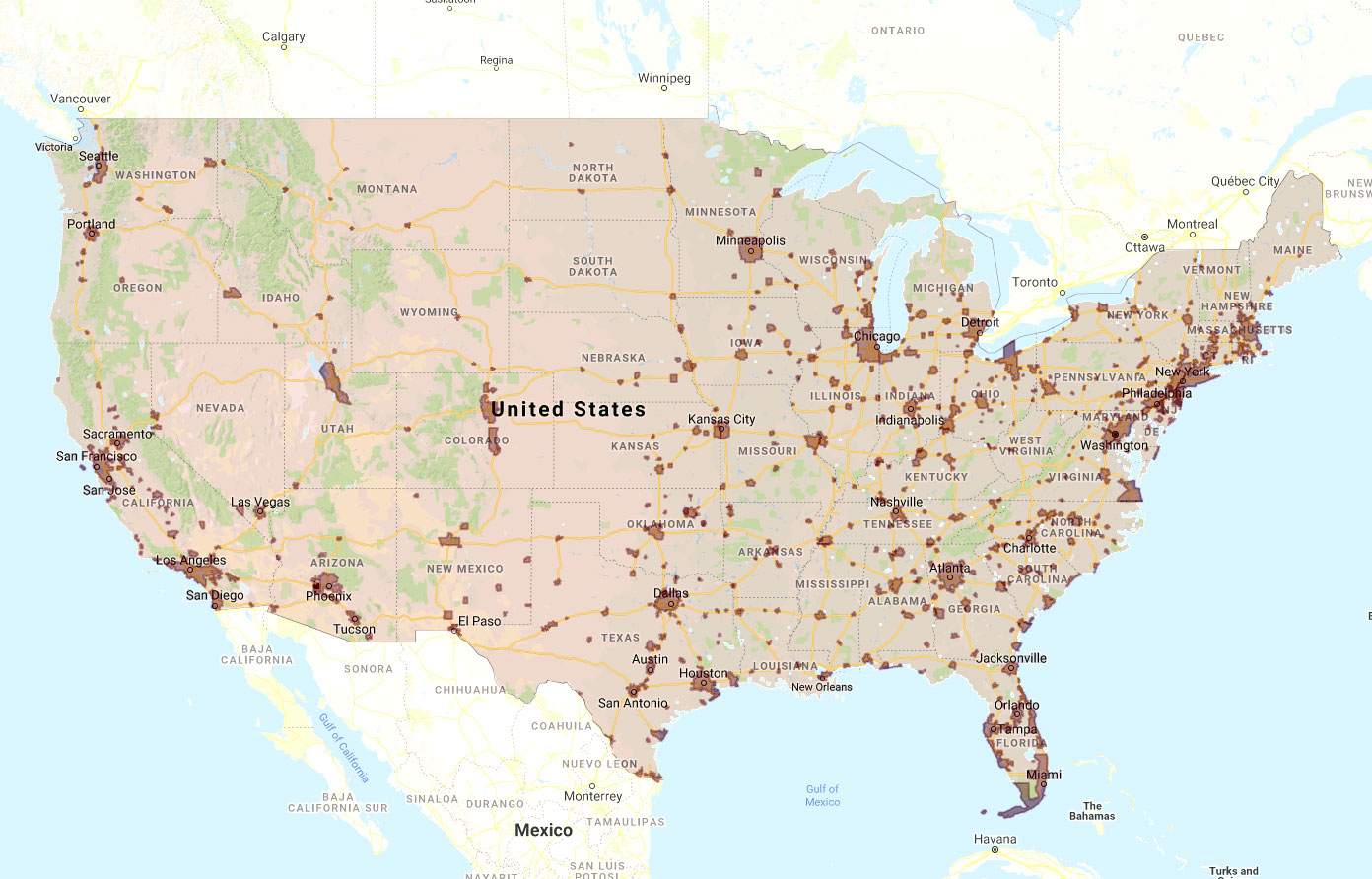

The United States Department of Agriculture (USDA) Rural Development program offers a valuable financial tool for homebuyers seeking to purchase property in eligible rural areas. In California, the program’s reach extends beyond traditional rural landscapes, encompassing a diverse range of locations that might surprise many. This article aims to demystify the USDA loan program in California, providing a comprehensive guide to its eligibility criteria, benefits, and how to access this vital resource.

Delving into the USDA Loan Program: A Closer Look

The USDA loan program, specifically the Single-Family Housing Guaranteed Loan Program, is designed to assist eligible individuals and families in purchasing a home in rural areas. The program operates through a partnership between the USDA and approved lenders, who provide the loan while the USDA guarantees a portion of the loan, minimizing risk for the lender. This approach allows the USDA to extend affordable financing options to individuals who might otherwise struggle to secure conventional mortgages.

Beyond Rural Stereotypes: Understanding California’s Eligibility

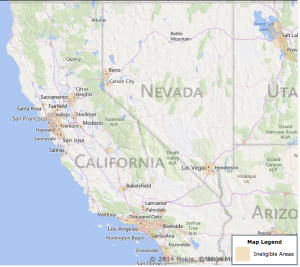

The definition of "rural" for USDA loan purposes is often misunderstood. In California, it encompasses areas beyond traditional farmland and small towns. The program’s eligibility criteria are based on specific census tracts, with many areas bordering major cities and suburbs qualifying for USDA loans.

The Advantages of a USDA Loan in California

- Low Down Payment: One of the most attractive features of a USDA loan is its low down payment requirement, often as low as 0%. This eliminates a significant financial hurdle for many homebuyers, especially those starting their homeownership journey.

- Competitive Interest Rates: USDA loans typically offer competitive interest rates, often lower than conventional mortgage rates, making homeownership more affordable.

- No Private Mortgage Insurance (PMI): Unlike conventional loans, USDA loans do not require private mortgage insurance, further reducing overall borrowing costs.

- Flexible Eligibility Criteria: The program caters to a wide range of borrowers, including first-time homebuyers, individuals with lower credit scores, and those with limited income.

- Support for Rural Communities: By promoting homeownership in rural areas, USDA loans contribute to the economic vitality and growth of these communities.

Navigating the USDA Loan Map in California: Finding Your Eligibility

To determine if your desired location qualifies for a USDA loan, several resources are available:

- USDA Rural Development Website: The official USDA Rural Development website provides an interactive map tool that allows users to search for eligible areas by address or zip code.

- USDA Loan Eligibility Map: Numerous online tools and websites offer maps specifically designed to illustrate USDA loan eligibility in California. These maps often incorporate census tract data and other relevant information.

- Local Real Estate Agents: Experienced real estate agents familiar with the local market can provide valuable insights into USDA loan eligibility and identify properties that meet the program’s requirements.

- Approved Lenders: Contacting approved USDA lenders in your area can also help you understand the program’s eligibility criteria and whether your specific location qualifies.

Key Eligibility Requirements for USDA Loans in California

- Location: The property must be located in an eligible rural area as defined by the USDA.

- Credit History: Borrowers must meet specific credit score requirements, typically a minimum score of 640.

- Income Limits: There are income limits for USDA loans, which vary based on household size and location.

- Debt-to-Income Ratio (DTI): The borrower’s DTI, representing the percentage of income allocated to debt payments, must fall within specified limits.

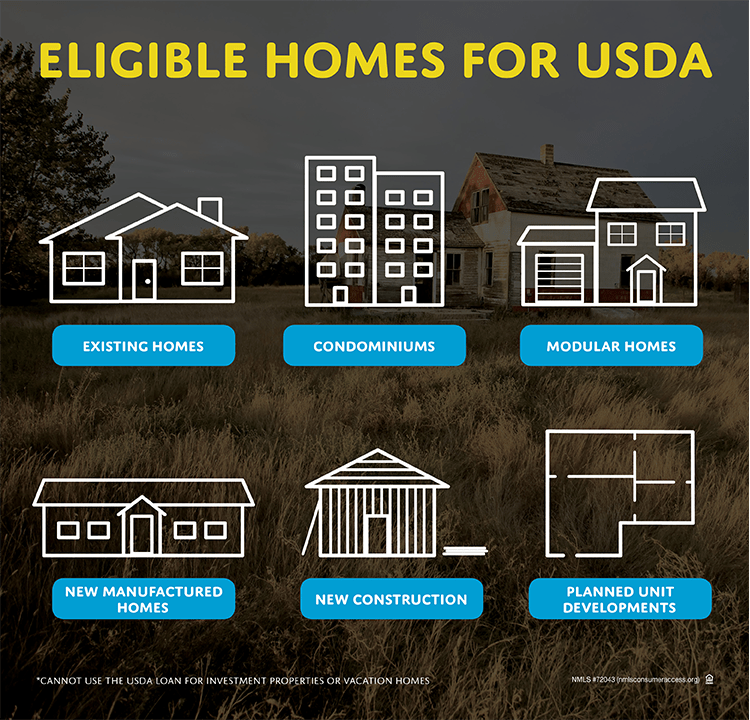

- Property Type: The loan can be used to purchase a single-family home, townhouse, condo, or manufactured home.

- Occupancy: The borrower must intend to occupy the property as their primary residence.

Understanding the Application Process: A Step-by-Step Guide

- Determine Eligibility: Begin by using the USDA Rural Development website or other resources to confirm your location’s eligibility.

- Find an Approved Lender: Identify a USDA-approved lender in your area.

- Gather Required Documents: Prepare necessary documents, including income verification, credit history, and property details.

- Submit Loan Application: Complete and submit your loan application to the chosen lender.

- Loan Approval and Closing: The lender will review your application, process the loan, and schedule the closing process.

FAQs: Addressing Common Questions About USDA Loans in California

Q: Can I use a USDA loan to purchase a property in a city or suburb?

A: While the USDA loan program primarily targets rural areas, some areas bordering cities and suburbs in California may qualify. It’s crucial to check the USDA eligibility map or consult with an approved lender to determine your location’s status.

Q: What are the typical interest rates for USDA loans?

A: Interest rates for USDA loans are generally competitive and often lower than conventional mortgages. However, rates can fluctuate based on market conditions and the borrower’s creditworthiness.

Q: Are there any closing costs associated with a USDA loan?

A: Yes, there are closing costs associated with USDA loans, similar to conventional mortgages. However, these costs can be negotiated with the lender and may be included in the loan amount.

Q: What are the income limits for USDA loans in California?

A: Income limits for USDA loans vary based on household size and location. The USDA website provides a tool for determining income limits for specific areas.

Q: Can I use a USDA loan to refinance my current mortgage?

A: Yes, the USDA offers a refinance program that allows eligible borrowers to refinance their existing mortgage with a USDA loan. This can be beneficial for homeowners seeking to lower their interest rate or consolidate debt.

Tips for Maximizing Your Chances of Securing a USDA Loan

- Improve Your Credit Score: Aim for a credit score of at least 640 to enhance your chances of approval.

- Shop Around for Lenders: Compare interest rates and fees from multiple USDA-approved lenders to find the best deal.

- Stay Organized: Gather all required documents and maintain clear communication with your lender throughout the process.

- Consider Your Long-Term Goals: Evaluate your financial situation and determine if a USDA loan aligns with your long-term homeownership aspirations.

Conclusion: Embracing the Opportunity of Affordable Homeownership

The USDA loan program in California offers a unique opportunity for individuals and families seeking to achieve the dream of homeownership. By understanding the program’s eligibility criteria, benefits, and application process, prospective borrowers can navigate the path to secure affordable financing and build a strong foundation for their future. The USDA loan program stands as a testament to the government’s commitment to supporting homeownership and fostering thriving communities across the state, making it a valuable resource for those seeking to establish roots in California’s diverse landscape.

![Usda Home Loan Requirements [Updated 2018] The Lenders Network - Usda](https://printablemapforyou.com/wp-content/uploads/2019/03/usda-home-loan-requirements-updated-2018-the-lenders-network-usda-map-california.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape: Understanding the USDA Loan Program in California. We thank you for taking the time to read this article. See you in our next article!