Navigating the Landscape: A Guide to the Schoharie County Tax Map

Related Articles: Navigating the Landscape: A Guide to the Schoharie County Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape: A Guide to the Schoharie County Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape: A Guide to the Schoharie County Tax Map

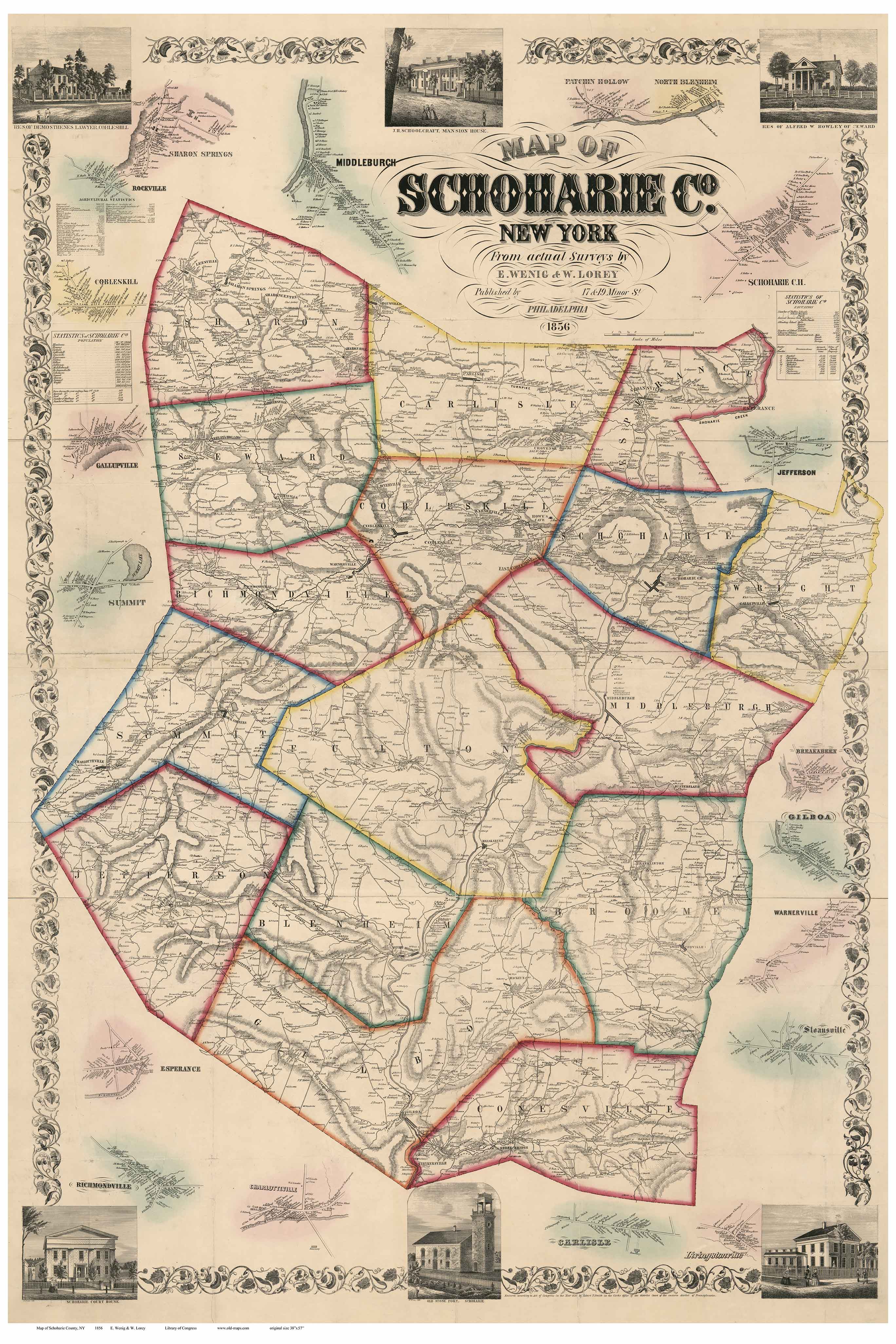

The Schoharie County Tax Map, a vital resource for residents, businesses, and government agencies alike, serves as a comprehensive guide to the county’s real estate landscape. This digital map, accessible online through the Schoharie County website, offers a detailed and organized representation of all properties within the county, providing invaluable information for a wide range of purposes.

Understanding the Structure:

The Schoharie County Tax Map utilizes a standardized system, employing a grid-based format to divide the county into distinct sections. Each section is assigned a unique identification number, making it easy to locate specific properties. The map itself is a visual representation of this grid system, with each grid square corresponding to a specific parcel of land.

Key Information at Your Fingertips:

The Schoharie County Tax Map provides a wealth of information about each property, including:

- Parcel Number: A unique identifier assigned to each individual property, serving as a primary reference point.

- Property Address: The official address of the property, ensuring accurate location identification.

- Property Owner: The name of the individual or entity who owns the property, facilitating contact and information retrieval.

- Property Size: The acreage or square footage of the property, offering a clear understanding of its dimensions.

- Property Type: The classification of the property, such as residential, commercial, or agricultural, providing insight into its intended use.

- Assessment Data: The assessed value of the property, serving as the basis for calculating property taxes.

Benefits of the Schoharie County Tax Map:

The Schoharie County Tax Map offers a multitude of benefits, making it an indispensable resource for various stakeholders:

- Property Owners: The map provides property owners with a clear understanding of their property’s boundaries, size, and assessed value, facilitating accurate tax payments and property management.

- Real Estate Professionals: Real estate agents and brokers utilize the map to identify properties, assess their values, and provide clients with detailed information, enhancing their services and facilitating informed decisions.

- Government Agencies: The map assists government agencies in managing property records, assessing taxes, and planning for future development, ensuring efficient and equitable administration.

- Community Members: The map empowers residents with access to essential information about their neighborhood, aiding in understanding property ownership, identifying potential development projects, and engaging in community planning.

Navigating the Map Effectively:

The Schoharie County Tax Map is user-friendly and intuitive, providing tools to navigate and search for specific properties:

- Search Functionality: The map offers a search bar where users can enter a property address, parcel number, or owner name to locate specific properties.

- Zoom and Pan Features: The map allows users to zoom in and out of specific areas, providing a detailed view of particular properties or neighborhoods.

- Interactive Layers: The map includes various interactive layers, such as road networks, zoning districts, and parcel boundaries, enabling users to filter and display relevant information.

Frequently Asked Questions:

Q: How do I access the Schoharie County Tax Map?

A: The Schoharie County Tax Map is accessible online through the official website of the Schoharie County Assessor’s Office.

Q: What information can I find on the Schoharie County Tax Map?

A: The map provides detailed information about each property, including its parcel number, address, owner, size, type, and assessed value.

Q: Can I use the Schoharie County Tax Map to find property boundaries?

A: Yes, the map displays parcel boundaries, providing a clear visual representation of each property’s limits.

Q: Is the Schoharie County Tax Map updated regularly?

A: The Schoharie County Assessor’s Office regularly updates the map to reflect any changes in property ownership, assessment data, or other relevant information.

Q: Can I download the Schoharie County Tax Map for offline use?

A: The availability of downloadable versions of the map may vary. Contact the Schoharie County Assessor’s Office for specific details.

Tips for Using the Schoharie County Tax Map:

- Familiarize yourself with the map’s layout and features.

- Use the search functionality to locate specific properties.

- Utilize the zoom and pan features to explore different areas.

- Experiment with the interactive layers to display relevant information.

- Contact the Schoharie County Assessor’s Office for any questions or assistance.

Conclusion:

The Schoharie County Tax Map serves as a vital resource for understanding the county’s real estate landscape. Its comprehensive information, user-friendly interface, and regular updates make it an invaluable tool for property owners, real estate professionals, government agencies, and community members. By leveraging the map’s features, users can gain insights into property ownership, assess values, and facilitate informed decisions, contributing to a well-informed and thriving community.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape: A Guide to the Schoharie County Tax Map. We thank you for taking the time to read this article. See you in our next article!